2023 saw major progress in Cyprus’ hydrocarbon exploration plans, supporting Cyprus’ ambitions to become a major player in the East Med.

Cyprus’ strategic location in the East Med, at the southeast tip of the European Union and close to the Suez Canal, make it ideally suited not only as an important headquartering location, but also as an energy interconnection node, connecting the electricity grids of the Eastern Mediterranean and North Africa to those of Europe.

Natural gas discoveries in both the Exclusive Economic Zone (EEZ) of Cyprus and its immediate neighbourhood over the last decade have spurred on a new industry in Cyprus providing new opportunities for business and foreign investment. A key driver for this has been the involvement of multinational oil and gas companies in Cyprus’ EEZ, which has strengthened the island’s ambition to become an important hydrocarbons player in the Eastern Mediterranean.

To date, Cyprus has completed three successful offshore licensing rounds, awarding the majority of its offshore blocks to some of the world’s top International Oil Companies (IOCs). Global energy giants such as Italian ENI, South Korean Kogas, French Total, American ExxonMobil, Qatar Petroleum, American Noble Energy, Israeli NewMed Group and Royal Dutch Shell, have all secured exploration rights in Cypriot waters. In July 2020, Chevron Corp announced an agreement for the acquisition of Noble Energy Inc, including its shares in Cyprus’ Aphrodite gas field. This is a positive development improving project realisation prospects, as after ExxonMobil, Chevron is the second biggest international oil company in terms of market capitalisation.

With the global oil and gas sector booming, exploration around the Eastern Mediterranean progressed well in 2023 – reconfirming the commitment of the IOCs to this region.

Natural Gas Discoveries

The first natural gas discovery in Cyprus’ EEZ was made in 2011 by US firm Noble Energy and Delek Group in the Aphrodite gas field in offshore Block 12, which is estimated to have 4.5 trillion cubic feet (tcf) of gas. Following a successful appraisal programme, Aphrodite was declared commercial in 2015. Following a successful second appraisal in 2023, Chevron submitted an updated development plan, currently under discussion. Chevron is expected to submit its final recommendation in April 2024.

The next discovery was made by the consortium of Total and ENI at the Onesiphoros prospect in Block 11 in 2017. But it was a small, technical and non-commercial discovery. This was followed by the discovery of the Calypso, Cronos and Zeus gas-fields in Block 6 by Italian ENI, starting in 2017. ENI recently completed its appraisal of the Cronos discovery and is expected to submit a development plan in 2024.

The ExxonMobil and Qatar Petroleum consortium was successful with the discovery in February 2019 of the Glaucus gas-field in the promising Block 10 , estimated to hold around 5 to 8 tcf of gas. This was followed by drilling an appraisal well in 2022, but the results are yet to be announced.

These discoveries were particularly encouraging as Glaucus, Calypso, Cronos and Zeus were discovered in geological formations similar to the giant 30 tcf Zohr gas-field discovered by ENI in 2015 in the Egyptian EEZ and adjacent to Cyprus’ Block 11. These more recent discoveries confirm that the Zohr geological model extends more widely in the Eastern Mediterranean region.

These results bode well for Cyprus and the East Med, adding to its reputation as an emerging gas region. Combined with other discoveries, they have roused interest amongst major players to invest in the Eastern Mediterranean. ExxonMobil extended its interests securing block 5 in Cyprus’ EEZ and licenses for two blocks southwest of Crete and in Egypt, where it secured Block 3. Chevron also extended its interest in Egypt, gaining rights to three offshore blocks, and in Israel taking over Noble Energy’s shares in the Tamar and Leviathan gas fields in Israel’s EEZ, while the major players in Egypt’s EEZ are ENI and British multinational oil giant BP.

Re-analysis of seismic survey data using the knowledge gained from these discoveries has shown good prospects for new, potential, discoveries also in Cyprus’ EEZ. As a result, ExxonMobil is planning to drill in Block 5 later this year. Depending on the results from the appraisal of Cronos, ENI and Total will be reviewing their plans in 2024. Success would further strengthen the potential of Cyprus as a gas province.

Potential Driver of Growth

The hopes that the oil and gas sector will become a key driver of economic growth are returning, and the prospects of gas exports could completely transform Cyprus’ fortunes.

Cyprus is actively re-evaluating its options to exploit its natural gas, hoping for high revenues in the future. Cyprus’ Energy Minister George Papanastasiou confirmed that Cyprus is working closely with the IOCs to ensure progression of these options. This includes the plan to sell around 8 billion cubic metres (bcm) of gas per year, over a 15-16-year period, from Aphrodite to Egypt for its own use and for liquefaction at the Idku plant in Egypt and to export this to global markets. The signing in 2018 of an inter-governmental agreement between Cyprus and Egypt to build a subsea pipeline connecting Aphrodite to Egypt’s liquefaction plants, and a revised production-sharing agreement with Noble Energy – now Chevron – and its partners over the Aphrodite gas reservoir are still key to monetising Aphrodite gas.

The revised agreement provides that the consortium will be responsible for the extraction platform at the site of the field. Analysts describe the deal as a redistribution of profit, increasing the share of the companies when oil prices are low, but conversely, when global oil prices rise, Cyprus’ share will increase. Based on reaching an agreement this year, first gas is expected in 2028, and according to the Energy Ministry it would be the biggest infrastructure project ever undertaken in the Republic of Cyprus. Currently, Cyprus and Egypt are committed to the plan.

In March 2021, Israel and Cyprus agreed a framework to deal with bilateral issues regarding the Aphrodite gas reserves. This is an important step towards the future development of the gas-field. This may be preceded by development of the Cronos gas-field by ENI. Following evaluation of the appraisal drilling results, ENI is expected to announce its development plans. These are likely to involve subsea production at Cronos, export by subsea pipeline to the Zohr production facilities and from there for processing in Egypt and liquefaction and export from ENI’s Damietta LNG plant in Egypt.

ExxonMobil plans to follow the discovery of Glaucus in Block 10 in 2019 by further exploration this year in block 5. ExxonMobil stated in the past that should more discoveries be made it would consider options for exports to global markets. This would require total gas discoveries to approach 10-15 tcf and global gas prices to justify commercial viability.

East Med Gas Forum

Given the geopolitical challenges the region faces, respect of international law, and particularly the United Nations Convention on the Law of the Sea (UNCLOS), is crucial to the peaceful exploitation of hydrocarbons in the East Med. With this in mind, the energy ministers and representatives from Egypt, Cyprus, Greece, Israel, Italy, Jordan and the Palestinian Authority met in Cairo in January 2019 and set up the East Mediterranean Gas Forum (EMGF) – with European Commission and World Bank representatives attending the meeting as observers. More recently, the US joined the Forum as an observer and France as a member, indicating its growing importance.

The EMGF could benefit regional gas development through dialogue on natural gas policies, including environmental considerations, leading to the development of a regional integrated market in a way that maximises the utilisation of gas resources and transport infrastructure in the region, and would contribute to further cooperation in the East Med. Gas export projects could also benefit from such cooperation, especially with regards to ensuring a conducive regulatory environment, putting in place the required inter-governmental arrangements and removing political risk. In 2021, the energy ministers of member countries mandated a dedicated working group to develop a long-term strategy to achieve the objectives of the EMGF. Natural gas could make a crucial contribution to the future of East Med countries and any such initiatives that could promote its development can only be helpful.

However, the so-called Cyprus Problem – the de facto division of Cyprus between the Greek-speaking south and the Turkish-speaking north following the 1974 Turkish invasion – continues to complicate geopolitics and hydrocarbons exploration in the Eastern Mediterranean. Turkey, a significant regional power, is not an UNCLOS signatory as it claims rights based on its continental shelf and has had an increasingly aggressive stance on oil and gas drilling rights in Cyprus’ EEZ. Tensions between Turkey and its neighbours and the EU have escalated in recent years with relations deteriorating further and establishing a political stalemate posing many potential challenges in future oil and gas development in the region. It is hoped that a rapprochement between Turkey and Greece may contribute to improving this situation in future. Another looming challenge is the ongoing war between Israel and Hamas in Gaza. Should this escalate further, it could potentially affect energy flows and oil and gas developments in the region.

LNG Import Terminal

Until it is able to develop its own gas, Cyprus is planning to import LNG to replace heavy fuel oil and diesel in power generation. Not only is this expected to bring the cost of electricity down, but it will also lead to a substantial reduction in carbon dioxide emissions, helping Cyprus achieve its Paris Agreement pledges.

In December 2019, Cyprus signed a landmark deal with a Chinese-led consortium to build a €290 million LNG import terminal at Vasilikos. The project secured a €101 million grant from the EU under the Connecting Europe Facility (CEF), with the Electricity Authority of Cyprus (EAC) contributing €43 million securing a 30% stake. Further financing comes from the European Investment Bank and the European Bank of Reconstruction and Development, with €150 million and €80 million respectively.

The terminal will include a floating storage and regasification unit (FSRU), a jetty for mooring the FSRU and related infrastructure at Vasilikos. An LNG carrier, the 137,000 m3 Galea, has completed conversion in Shanghai into an FSRU and is now awaiting certification.

Construction of the terminal at Vasilikos started in July 2020, and even though it has been beset by problems and delays, completion is expected by the end of 2024. To date this is Cyprus’ largest energy infrastructure project. Cyprus Energy Minister George Papanastasiou said that the project is central to the reduction in energy-related carbon emissions, to lower electricity prices, and to the success of electricity market liberalisation. He also said that the future use of natural gas from Cyprus’ own gas fields is still part of the country’s strategy for the future.

Connecting Power Grids

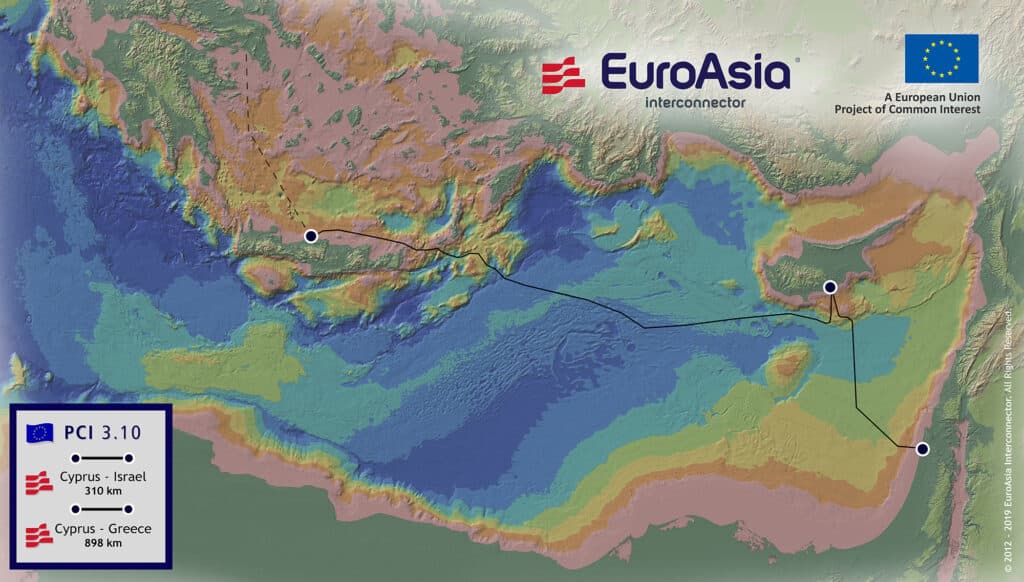

Another important regional energy project is the Great Sea Interconnector (previously known as the EuroAsia Interconnector), which will link the power grids of Cyprus with Greece and eventually Israel via an undersea cable. The 2,000-Megawatt (MW) Interconnector is the only North-South electricity interconnection in the Central Eastern and South Eastern Europe Priority Corridor. Operatorship has been passed to Greek grid-operator ADMIE. The Cyprus government is considering joining the project as a shareholder. UAE’s TAQA is also in discussions to invest in the project. It has secured €657 million funding through the Connecting Europe Facility and €100 million from Cyprus’ Recovery and Resilience Fund.

The permitting procedure for the construction of the first power ‘corridor’ with a capacity of 1,000 MW costing €3.5 billion started in 2019. The Crete-Attica link – being built by ADMIE – is expected to be completed by 2024, and the €1.9 billion Cyprus-Crete link in 2029. The Cyprus-Israel link will follow once an agreement is reached with Israel.

The Interconnector will end the energy isolation of Cyprus and contribute to achieving the EU Energy Union’s goals of connecting European energy networks, achieving the electricity interconnection target for 2030 of at least 15%. It will also contribute to the internal energy market integration, increase security of energy supply, and support sustainable development by integrating renewable energy sources across the EU.

An important milestone was achieved in July 2020, when the government of Cyprus issued the Interconnector with the final building permit to construct a high voltage direct current (HVDC) converter station in Cyprus, with a capacity of 2,000 MW. Following tenders issued in February 2021, the turnkey contract for the supply and installation of the HVDC cable systems was awarded to Nexans, with construction scheduled to start this year.

Fuel Transhipment Terminal

Concurrently, Cyprus is also developing into a regional fuel hub for Europe, Asia and Africa, thanks mainly to the successful operation of the sophisticated oil storage terminal by Netherlands-based global oil terminal company VTTI. The company’s €300 million project in Vasilikos became operational in 2014 and was one of the biggest infrastructure projects constructed in Cyprus in recent years and put the island on the global energy map.

The company uses Cyprus as a transhipment terminal, blending its raw materials and then exporting them to the rest of the world. With large refineries operating and more being built in the Middle East, the international market expects more product-vessel traffic through the Suez Canal, bound for European and Mediterranean markets. These cargoes need to be resized or blended with other products to change specification and meet regional requirements. VTTV’s strategic location makes it the first terminal of its kind in the Eastern Mediterranean offering these services and connecting Europe and the Black Sea with markets in the Middle East and Asia. The industry has tremendous growth prospects with Cyprus’ determination to establish itself as a key energy hub and a stronghold of stability in the region.

A Geostrategic Player

With increased regional cooperation and the unfolding discoveries in the Eastern Mediterranean, the growing potential of the developing oil and gas sector offers expanding opportunities for investors. In a turbulent region, Cyprus is well positioned to further strengthen its role as a stable and attractive location in which to base energy infrastructure projects and headquarters for international companies servicing the region. The country’s EU status, vast pool of English-speaking professionals, one of the highest concentrations of university graduates in the region, and its beneficial business operating environment provide the island with unique advantages to establish itself as a strategic player and facilitator in the EMEA energy market.

For more information, contact Cyprus' investment promotion agency, Invest Cyprus.

All rights reserved. The material on this site may not be reproduced, distributed, transmitted, cached, or otherwise used, except with the prior written permission of The Profiler Group.

January 2024