Directory

Patrikios Legal stands out in the local and international legal market since 1963. Renowned for its top-tier core practices, our lawyers' expertise, innovative thinking, and client responsiveness are consistently recognized globally in international rankings.

Our firm's extensive experience in cross-border legal work, coupled with strong ties to international law firms, sets us apart. Serving leading multinational corporations, banks, and individuals, Patrikios Legal offers comprehensive legal solutions across diverse practice areas including Dispute Resolution, Banking, Finance, Tax, Corporate, Commercial and Real Estate.

Embracing change and adaptability, Patrikios Pavlou & Associates LLC has celebrated its 60th anniversary in 2023 and has rebranded into Patrikios Legal, reflecting our commitment to providing current and accessible legal services and addressing clients' evolving needs in a dynamic world.

Dispute resolution & ADR: the largest and most experienced department of the firm handling cases in conventional and alternative forms of litigation, including arbitration of international and domestic disputes and mediation. The department’s transnational capabilities and experience are substantial since lawyers have arbitrated many commercial disputes in arbitration courts all over Cyprus and abroad.

Corporate, commercial and M&As: one of the internationally recognized and multi-awarded areas of the firm with a reputation for providing high quality consultancy services to clients. The department handles complicated cross-border transactions including major mergers and acquisitions and assists large groups of companies and prestigious international law firms on Cyprus law issues.

Banking and finance: one of the most successful and well-established departments in Cyprus. The team successfully handles challenging cross-border corporate finance transactions and provides assistance to a wide variety of banking projects to major European, Russian, other international banks and other companies in the financial services sector. The department also has extensive experience in the provision of legal advice in the listings of major companies on local and international stock exchanges.

Corporate management services: through its close associate Pagecorp Group, the firm offers comprehensive corporate services such as the provision of company secretarial, trustee, administration and management services to a variety of clients in Cyprus and abroad.

International tax planning: the department has expertise in assisting clients in the implementation of effective tax planning structures designed to minimize their tax liabilities activities and meet their financial and business objectives. The department provides comprehensive advice on various tax matters, on complicated tax structures to domestic and international clients and on possible tax implications arising from cross-border mergers and acquisitions.

The firm’s legal team also provides professional services in several other practice areas such as trusts & asset protection, IT, internet and e-commerce law, competition and EU law, real estate, intellectual property, administrative law, matrimonial and family law, ship registration and ship finance.

Patrikios Pavlou & Associates LLC invests continually in developing its expertise in order to further expand both locally and internationally. The firm’s participation in international professional bodies, as well as, the prominent relationships with international law firms and major organizations are the cornerstones of the firm’s future plans and strategies. The firm reiterates its commitment that it will continue to provide top quality legal services with diligence, integrity and professionalism for the next 50 years and even longer.

We are pleased to announce that Stella Strati, Partner – Head of Corporate and Private Client at Patrikios Legal, will be attending the 31st Annual International Private Client Tax Conference: “Private Wealth – Seeking Shelter and Opportunity Alike”, organised by the International Bar Association (IBA) between 1-3 March 2026 in London.

Read full articleWe are pleased to congratulate our Senior Associate Stavroulla Nicolaou, on successfully passing the Insolvency Practitioner examinations. This important achievement reflects both her professional dedication and our firm’s continued investment in the highly specialised area of restructuring and insolvency.

Read full articleWe are happy to share that our colleagues Joseph Evangelou, Sophia Christodoulou, and Marilia Pavlou, recently attended the Cyprus FinTech Summit 2025 which took place in Limassol between 2-3 December, held by the industry’s leading innovators and thought-leaders. The Summit brings together fintech startups, established financial institutions, regulators, tech enthusiasts, and legal experts to explore emerging trends and challenges in financial technology, digital banking, fintech regulation and innovation.

Read full articleOn Saturday, 22 November 2025, the annual charity event Wish for the Stars – Bands Edition lit up Monte Caputo, Limassol, bringing together hundreds of supporters for an unforgettable evening dedicated to giving back. As one of the co-organisers of this remarkable initiative, Patrikios Legal is proud to share the resounding success of this year’s event.

Read full articleWe are delighted to share that our Partner-Head of International Disputes Marina Hadjisoteriou is participating as a speaker at the International Women’s Insolvency & Restructuring Confederation (IWIRC) Europe 2025 Annual Conference, taking place on 21 November 2025 in the vibrant city of Rome. This revolutionary event brings together leading restructuring, insolvency, and disputes professionals from across Europe for a day of high-level dialogue and meaningful networking.

Read full articleWe’re proud to share that Marina Hadjisoteriou FCIArb, our Partner – Head of International Disputes was a speaker at London International Disputes Week (LIDW), joining a distinguished panel to explore the future of fraud, AI, and crypto in a session titled “Fraud 2050: Peering into the crystal ball of tomorrow’s threats.”

Read full articleWe’re excited to share that Angelos Onisiforou Partner – Financial, Commercial, VAT, Angeliki Epaminonda Partner – Financial, Corporate, M&A, and Nikoleta Christofidi Senior Associate successfully represented National Paints, a Dubai based company being one of the largest paint consortiums in the Middle East, in the acquisition of Viostik Ltd, one of the oldest and most respected companies in its field in Cyprus.

Read full articlePatrikios Legal was proud to co-organise as a Gold Sponsor at Cyprus Arbitration Days 2025, a leading international arbitration event hosted in Limassol. The event brought together distinguished legal professionals, arbitrators, and thought leaders from around the globe to engage in meaningful dialogue on the future of arbitration.

Read full articleWe are pleased to announce that both Stavros Pavlou, FCIArb, BSc (Econ), Barrister, TEP, Executive Chairman and Co-Chair of Cyprus Arbitration Day, and Marina Hadjisoteriou, Partner – Head of International Disputes, will be speaking at Cyprus Arbitration Day 2025, to be held on 16 May 2025.

Read full article

Our Executive Chairman Stavros Pavlou, FCIArb, Bsc (Econ), Barrister, TEP and Partner – Corporate Finance, Tax, Private Client Stella Strati will be heading up the panel together for a 3 hour seminar titled: “Cyprus Professional services: Key considerations, Hot topics & Practical Cases” organised by: Cyprus Fiduciary Association

Read full articleIn a special ceremony held at the Cyprus University of Technology Rector’s Office, 5 scholarships totalling a sum of 5 thousand Euros were awarded by our firm to students of the university. The scholarships were awarded to students with financial problems who had a proven desire and ability to study, improving their prospects in life.

Read full article

In a landmark decision, the Tax Tribunal vindicated Antonis Askanis Ltd by annulling a VAT assessment of €1,261,344 imposed by the Tax Commissioner. Patrikios Legal played a crucial role in this victory, with Partner Angelos Onisiforou co-contributing key arguments along with representatives from Chelco VAT Ltd and Antonis Askanis Ltd, who were instrumental in securing this favourable outcome.

Read full articleGlobal Advocaten is an exclusive network of independent law firms in more than 27 countries. Founded in 1990 as Euro Advocaten, the organization has grown from the original five lawyers to over 1,400 lawyers representing 23 member firms. Firms have exclusivity within the jurisdictions in which they operate, with rare exceptions being made with approval from both the prospective firm and the member firm. Global Advocaten is proud to be ranked in the Chambers Europe 2024 guide.

Read full articleThe Chambers Europe 2024 guide highly recommends our firm and its lawyers for the General Business Law and General Business Law: Dispute Resolution areas in Cyprus. The renowned guide just released its rankings and remarkable feedback from clients; a sample quote is “the lawyers had very strong commercial awareness, especially with regard to new legislative amendments and practical matters.”

Read full articleWe are thrilled to announce that our office, Patrikios Legal, is joining hands once again as one of the co-organizers of the highly-anticipated charity event, “Wish for the Stars – Eurovision Edition,” in support of the “One Dream One Wish” Pancyprian Association for Children with Cancer and Related Diseases.

Read full articleIn the wake of the collapse of FTX, which was ranked as the world’s third-largest cryptocurrency exchange just days before declaring bankruptcy[1], this is a concise attempt to comprehend what caused the downfall of the cryptocurrency giant in layman’s terms and appreciate the lack of regulatory oversight, auditing and corporate governance failures exposed from this saga.

Read full articleOn the 4th June 2018 the Republic of Cyprus along with 21 other Member States and Norway agreed to sign a Declaration creating a European Blockchain Partnership for the specific purpose of establishing a European Blockchain Services Infrastructure. The ambition and underlying purpose of this European Blockchain Partnership, was to support the delivery of cross-border digital public services, enhance the security and privacy of this sector and (although not expressly stated) to prevent any potential calamities in the financial-blockchain sector.

Read full articleFollowing the recent unfortunate events, new sanctions and restrictive measures have been imposed against a number of Russian financial institutions, entities and individuals. This is a fast-changing and irregular situation, and the regulations imposing restrictive measures are continuously revised and updated. Regulators in Cyprus have issued announcements and circulars to Regulated Entities in relation to their obligations to abide by the applicable restrictive measures and implement and maintain a sanctions policy.

Read full articleGiven the constantly changing global corporate environment, shifting business needs and closer scrutiny in an effort to prevent and suppress money laundering and profit shifting, as well as the requirement for enhanced substance, companies are being called to re-evaluate and challenge their existing structures.

Read full articleThe new Enforcement of Judgments guide features 29 jurisdictions. The guide provides the latest legal information on the identification of another party’s asset position, the costs and time involved in the enforcement of domestic and foreign judgments, challenges to enforcement, and the process of enforcing arbitral awards.

Read full articleWe are proud to be the first Cyprus law firm to support the Campaign for Greener Arbitrations, which is dedicated to the implementation of the Green Protocols in each region of the world, with particular attention to regional specificities! The Campaign seeks to raise awareness of the significant carbon footprint of the arbitration community.

Read full articleThe Legal 500’s Hall of Fame recognizes our Senior and Managing Partner, Stavros Pavlou, as “one of the 2-3 best and most bright Cypriot litigators” and “a true master of strategic thinking” in the Dispute Resolution area. He is recommended “without any reservation” for being “a prominent arbitrator locally and internationally” and for finding a way to cut through complexity. He is further a leading individual in Tax and an expert international tax advisor and trust practitioner, while he is also highly recommended as an expert in Corporate, Commercial and M&A, Banking and Finance and Real Estate & Construction.

Read full articleChambers & Partners’ International Arbitration 2020 practice guide features 47 jurisdictions. Stavros Pavlou, Eleana Christofi, Theodoros Symeonides, and Athina Patsalidou provide expert legal commentary on tribunals, preliminary and interim relief, collection and submission of evidence, confidentiality, types of remedies, class actions, and grounds for appeal and enforcement in Cyprus.

Read full articleThe Covid-19 crisis is first and foremost a humanitarian crisis and one that raises fears for the health of ourselves, our loved ones, our families, our co-workers and friends. The cohesion of society itself is at risk and the survival of vulnerable people and businesses threatened. Institutions such as the health services, governmental authorities, banks, even organised religion are all tested and many are found seriously wanting.

Read full articleThe recent revelations in the Panama and Paradise Papers illustrated the need for companies to make a shift towards more responsible fiscal behaviour and tax responsibilities. International guidelines such as the OECD guidelines and the 4th EU AML Directive clarify that evasive fiscal practices will be disclosed. This article analyses the implications on some of the most established corporate structure vehicles, British Virgin Islands (BVI) business companies and Cyprus companies, by outlining their key characteristics and evaluating how each jurisdiction is adhering to stricter international compliance standards.

Read full articleIn November 2017, the Cyprus parliament voted an important amendment to the Cyprus VAT Legislation, which amends the main VAT Law N.95(I)/2000 concerning taxation of building land, in order to align it with the provisions of EU VAT Directive 2006/112/EC. The amendment has entered into force on 2 January 2018.

Read full articleThe Cyprus Ministry of Finance has announced that Cyprus has entered into a double tax agreement with Saudi Arabia for the avoidance of double taxation (‘DTT’), which aims to prevent tax evasion. The DTT was signed on January 3, 2018, in Riyadh during an official visit of the President of Cyprus there and is expected to be ratified and come into force as from 1 January 2019.

Read full articleIn November 2017, the Cyprus parliament voted a significant amendment to the Cyprus VAT Legislation (VAT Law – Amending Law No. 3) which amends the main VAT Law N.95(I)/2000 concerning taxation of building land, in order to align it with the provisions of EU VAT Directive 2006/112/EC. The amendment was published in the Official Gazette on 13 November 2017 and will come into force on 2 January 2018.

Read full articleThe Cyprus Tax Department (CTD) has notified the Institute of Certified Public Accountants of Cyprus (ICPAC) of their policy change in terminating the application of the pre-agreed minimum profit margins of 0.125% – 0.35% on qualifying intra-group back to back financing arrangements, with effect from 1 July 2017.

Read full articleThe Cyprus Minister of Finance issued a Decree on 30 December 2016, introducing a mandatory Country by Country (CBC) reporting requirement for multinational enterprise groups generating consolidated annual turnover exceeding €750m (MNE Group). The Decree is compliant with the EU Directive 2016/881 amending Directive 2011/16 relating to mandatory automatic exchange of information in the field of taxation and the OECD BEPS Action 13 on transfer pricing documentation and country by country reporting.

Read full articleThe Russian Arbitration Association (RAA) organised a very interesting conference on “Collecting Bad Debts: Throwing Good Money after Bad?” which included stimulatingtopics in the areas of assets tracing, assets freezing, arbitration and 3rd party funding. The event took place at Marriott Novy Arbat Hotel in Moscow, The Russian Federation, on 29th June 2016.

Read full articleOnce again, Patrikios Pavlou & Associates was present at the Euroadvocaten meeting in Milan, Italy, which took place on 23 and 24 April 2015 at the Grand Hotel et de Milan. Ms Angeliki Epaminondas, senior lawyer of our law Firm attended the meeting, representing Patrikios Pavlou & Associates LLC.

Read full articleDuring the 50th Anniversary celebration, which took place on 18th October 2013 at the Four Seasons Hotel in Limassol, the management of Patrikios Pavlou & Associates LLC announced that an amount, equivalent to the cost of the event, will be donated to several charitable organisations who support poor families, children and ill people throughout Cyprus.

Read full article

We are pleased to announce that Stella Strati, Partner – Head of Corporate and Private Client at Patrikios Legal, will be attending the 31st Annual International Private Client Tax Conference: “Private Wealth – Seeking Shelter and Opportunity Alike”, organised by the International Bar Association (IBA) between 1-3 March 2026 in London.

Read full article

Modernizing International Arbitration Law in Cyprus – Asian Dispute Review

Arbitration Procedures and Practice in Cyprus: Overview 31/07/2025

Litigation and Enforcement in Cyprus: Overview

International Arbitration Laws and Regulations – Cyprus

Patrikios Legal: Employee Privacy & Personal Mobile Phones at Work

Patrikios Legal: Law Over Borders Comparative Guides – Mediation Cyprus

Patrikios Legal: Estate planning: Let’s discuss Digital Assets

Patrikios Legal: Cyprus: An attractive, promising forum for dispute resolution Friday 4 April 2025

Patrikios Legal: Is Cyprus still an attractive destination for Family Offices?

Patrikios Legal: How to Choose the Right Bank for Your Business — and Why It Matters

Patrikios Legal: Cyprus Digital Nomads: Applications Now Open

Patrikios Legal: Presentation at the International Bar Association conference “Litigating in the middle east” Feb 2025

Patrikios Legal: Important Changes to the Beneficial Owners’ Register in Cyprus

Patrikios Legal: CYPRUS: START-UP VISA SCHEME REVISED

Cyprus Private Client 2025!

Patrikios Legal: Insolvency Litigation Cyprus 2024!

Patrikios Legal: Destination Cyprus

Patrikios Legal: ICLG – International Arbitration 2024!

Patrikios Legal: ICLG – Alternative Investment Funds 2024!

Patrikios Legal: Mergers Divisions And Conversions 2024!

Patrikios Legal: Extending the reach of EU sanctions!

Patrikios Legal: Sanctions related to vessels – an update

Patrikios Legal: ESOPs And Their Taxation In Cyprus

Patrikios Legal: Derivatives 2024

Patrikios Legal: Derivatives 2024!

Patrikios Legal: Do Employers have a duty to provide written information on basic terms and conditions of employment?

Patrikios Legal: Law on Transparent and Predictable Working Conditions!

Patrikios Legal: Cyprus Sanctions 2024

Patrikios Legal: Shedding Light On The Recent Regulation of AI!

Patrikios Legal: Shedding Light On The Recent Regulation of AI!

Patrikios Legal: ICLG – Project Finance 2024!

Patrikios Legal: In-Depth Real Estate Law by Lexology

Patrikios Legal: Cyprus Interest Income and How to Tax it

Patrikios Legal: Navigating the shifting tides: Upcoming changes on the Cyprus tax landscape

Patrikios Legal: Passive income taxation

Patrikios Legal: Lexology GTDT – Insolvency Litigation 2023 – Cyprus

Patrikios Legal: ICLG – International Arbitration 2023

Patrikios Legal: Sanctions – Lexology, Getting the Deal Through

ICLG – International Arbitration 2023

A new era for the Cyprus justice system

Transferring Title to Immovable Property in Cyprus

New Civil Procedure Rules to Take Effect

Trust Wisely: Establishing a Cyprus International Trust

Reorganizations

Law Firm’s Compliance Officers

Maximizing Employee Engagement

International Comparative Legal Guide – Derivatives 2023

Introducing the new employee’s work-life balance law

The Real Estate Review 2022

Lending & Taking Security in Cyprus

Chambers Global Guide to Corporate Tax – Cyprus 2022

The Inward Investment and International Taxation Review

The Complex Commercial Litigation Law Review

The era of environmentally & socially conscious entities: ESG in Cyprus

Patrikios Pavlou & Associates LLC: The number of arbitrators and a preliminary award in a multi-party arbitration in Cyprus

Patrikios Pavlou & Associates LLC: Litigation and enforcement in Cyprus: overview

Patrikios Pavlou & Associates LLC: The Real Estate Law Review

Patrikios Pavlou & Associates LLC: Family Offices: Current Challenges and Trends

Patrikios Pavlou & Associates LLC: The Inward Investment and International Taxation Review

Patrikios Pavlou & Associates LLC: Arbitration procedures and practice in Cyprus: overview

Patrikios Pavlou & Associates LLC: Depositary Duties in the Alternative Investment Funds Realm

Patrikios Pavlou & Associates LLC: Lending and taking security in Cyprus: overview

Patrikios Pavlou & Associates LLC: “Mini Fund Manager” – An Alternative Powerful and Cost-Efficient Vehicle

Patrikios Pavlou & Associates LLC: Types of Cyprus Funds

Patrikios Pavlou & Associates LLC: The Complex Commercial Litigation Law Review

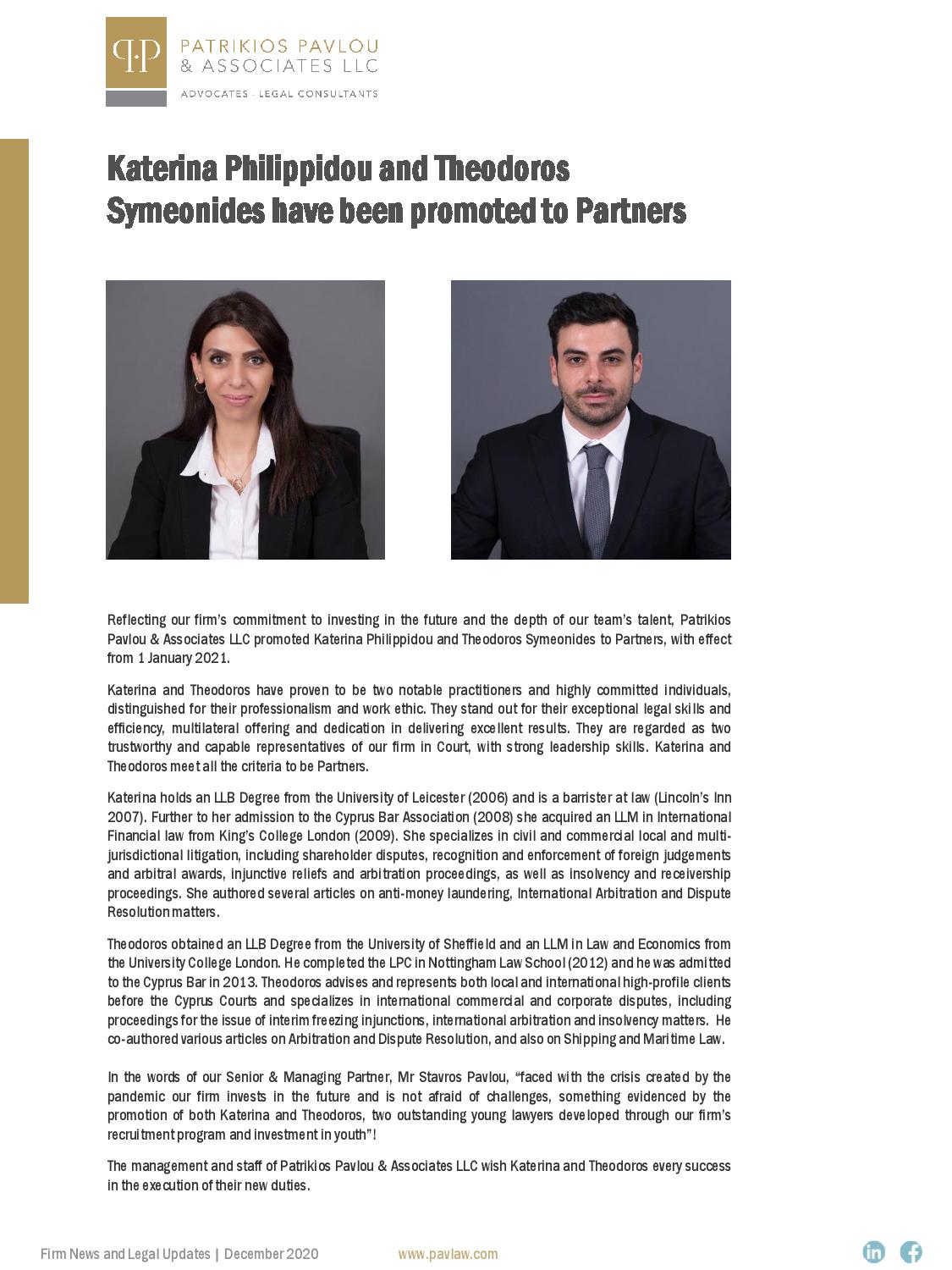

Patrikios Pavlou & Associates LLC News: Katerina Philippidou and Theodoros Symeonides have been promoted to Partners

Patrikios Pavlou & Associates LLC News: Eight of our lawyers have been appointed in Committees of the Cyprus Bar Association

Patrikios Pavlou & Associates LLC: Project Finance 2021

Patrikios Pavlou & Associates LLC: Enforcement of Judgments – Cyprus 2020

Patrikios Pavlou & Associates LLC: All About Nexus - Link your IP asset to Cyprus

Patrikios Pavlou & Associates LLC: The Legal 500 Country Comparative Guides

Patrikios Pavlou & Associates LLC: Podcast ‘Alternative Dispute Resolution: The Road to the Future’

Patrikios Pavlou & Associates LLC: Cyprus and the “new normal”, reasons to invest

Patrikios Pavlou & Associates LLC: Chilidescu v. Gheorghiu

Patrikios Pavlou & Associates LLC: COVID-19: Legal reflections on virtual closings

Patrikios Pavlou & Associates LLC: The Legal 500 - Leading legal experts in Europe, Middle East & Africa

Patrikios Pavlou & Associates LLC: A MULTI-TOP TIER law firm for The Legal 500 once more

Patrikios Pavlou & Associates LLC: Transforming General Meetings: Covid and other “viruses”

Patrikios Pavlou & Associates LLC: Regulatory Update Alert AIFs and UCITS: New Depositary Safekeeping Rules

Beyond Majeure. Legal implications of the COVID-19 epidemic on contractual obligations under Cyprus Law.

Key points on the legal framework guiding the validity of electronic signatures in Cyprus. The (digital) silver lining of COVID-19.

Patrikios Pavlou & Associates LLC: Potential Implications of the Quarantining to Tax Residency

Patrikios Pavlou & Associates: The Inward Investment and International Taxation Review

Patrikios Pavlou & Associates LLC: Firm News and Legal Updates February 2020

Litigation and enforcement in Cyprus: overview

Arbitration procedures and practice in Cyprus: overview

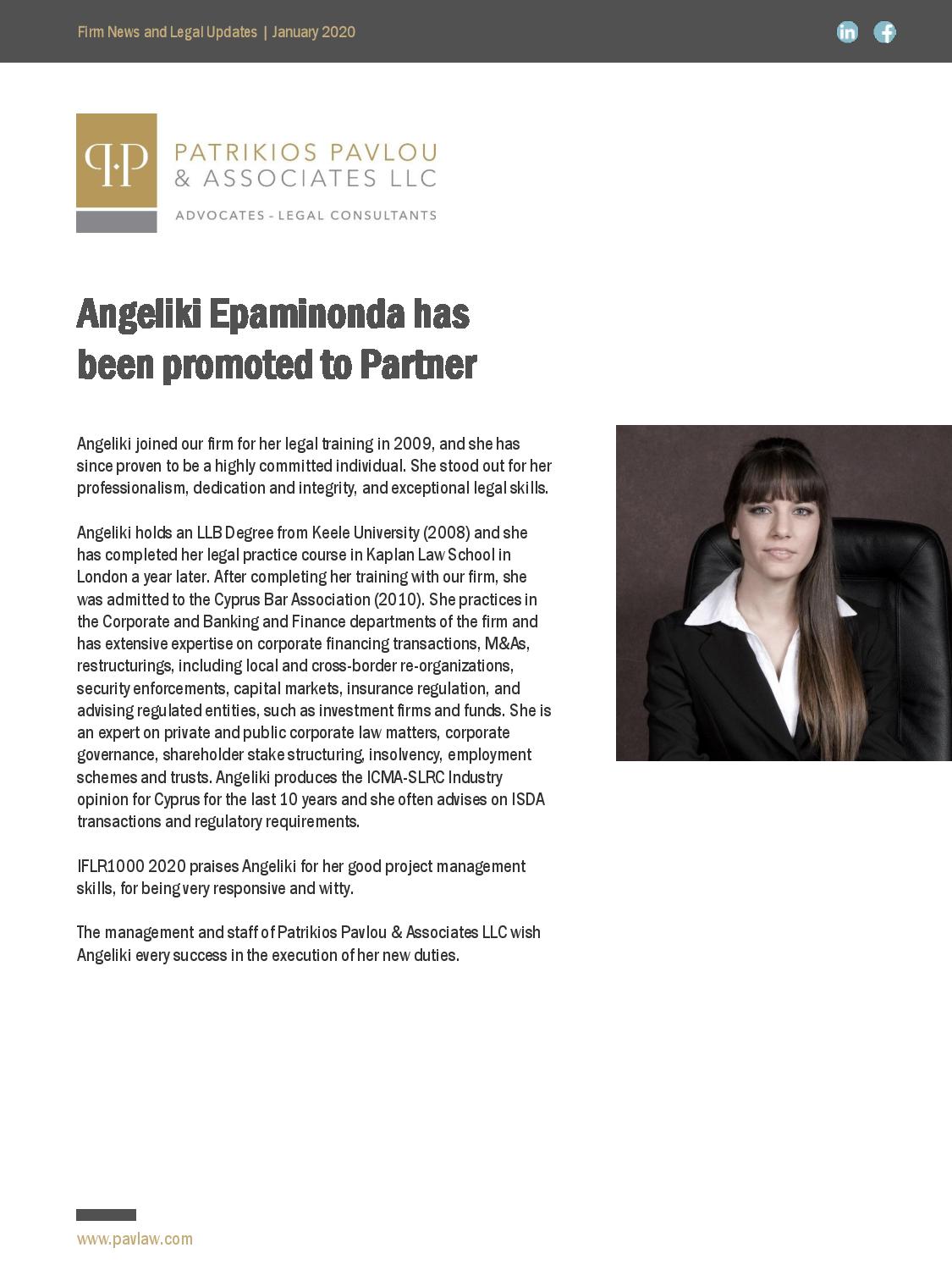

Patrikios Pavlou & Associates LLC: Firm News and Legal Updates January 2020

Patrikios Pavlou & Associates LLC: Firm News and Legal Updates Oct 2019

Patrikios Pavlou & Associates LLC: Thriving in Regulation: The case for DLTs

Patrikios Pavlou & Associates LLC: Congratulations to our Team!

Patrikios Pavlou & Associates LLC: Upcoming conferences September 2019

Cyprus Implements ATAD

Limits to extension of the arbitration agreement in Cyprus

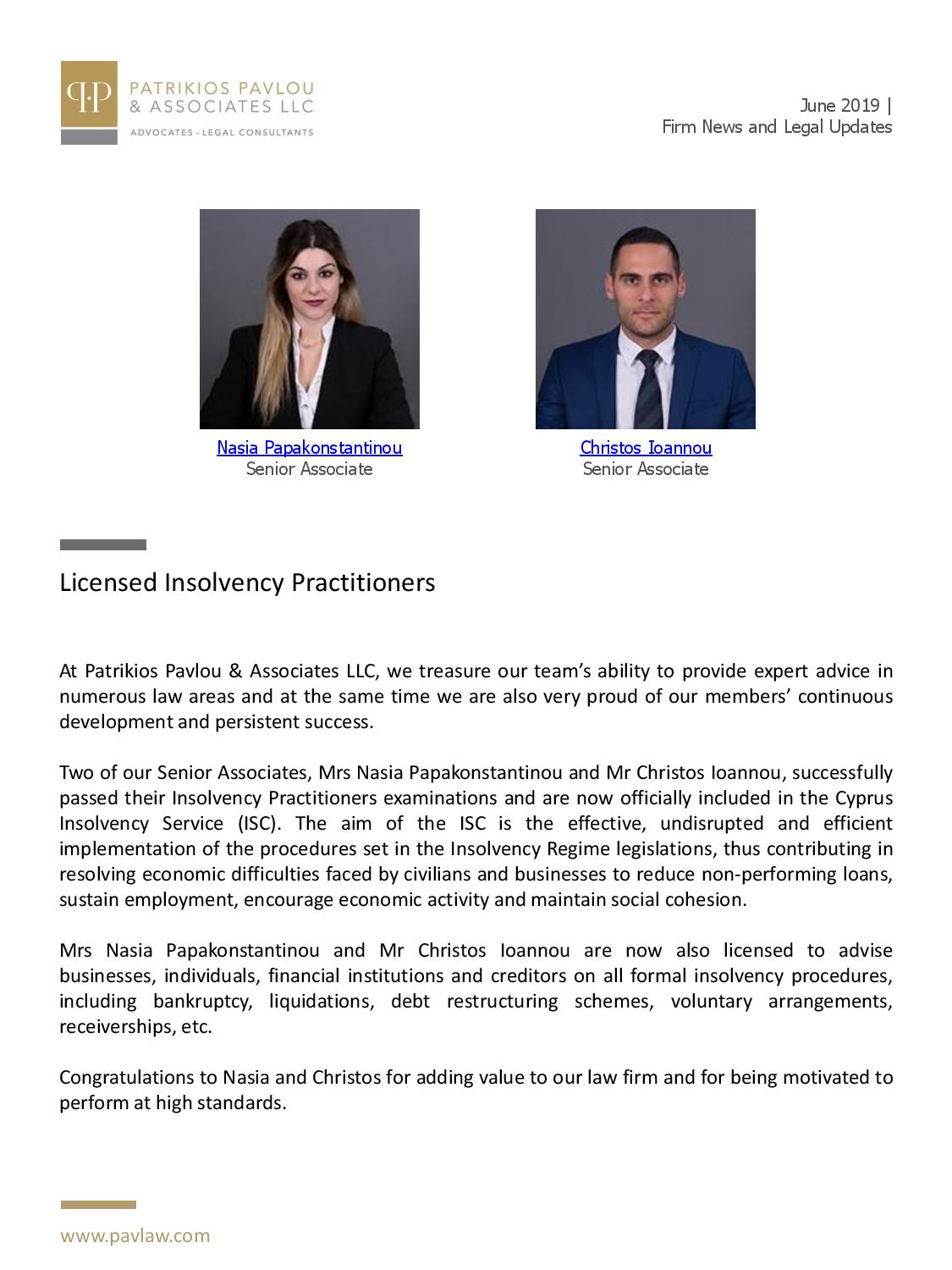

Patrikios Pavlou & Associates LLC Newsletter June 2019

Patrikios Pavlou & Associates LLC Newsletter April 2019

Patrikios Pavlou & Associates LLC Newsletter March 2019 Update

Patrikios Pavlou & Associates LLC Newsletter March 2019

M&A opportunities in Cyprus post-Brexit

Patrician Chambers, 332 Agiou Andreou Street, Limassol, Cyprus

Tel: (+357) 25 871 599

Fax: (+357) 25 344 548

Email: info@pavlaw.com

Website: Visit

website

Executive Chairman